Greetings.

I’m not an expert in finance and investing. I know enough to be able to distinguish between good and bad investing advice.

You don’t have to be a pro to start investing. In fact, almost 80% of “pros” regularly underperform the market. How is that possible? Shouldn’t the experts be able to beat the market consistently? Well, they should, but picking stocks is extremely complicated. There are plenty of financial and human factors one must consider when deciding what to buy or sell. And even if the price goes up is that because you made the right call or was it pure luck? It’s hard to investigate the correlation between one’s decision and the final outcome.

So if Trust Funds can’t beat the market then who can? The short answer is almost nobody. But don’t get discouraged. This is great news. Why? Just invest in the whole stock market. The best and safest approach is to invest in an index fund and leave your money there.

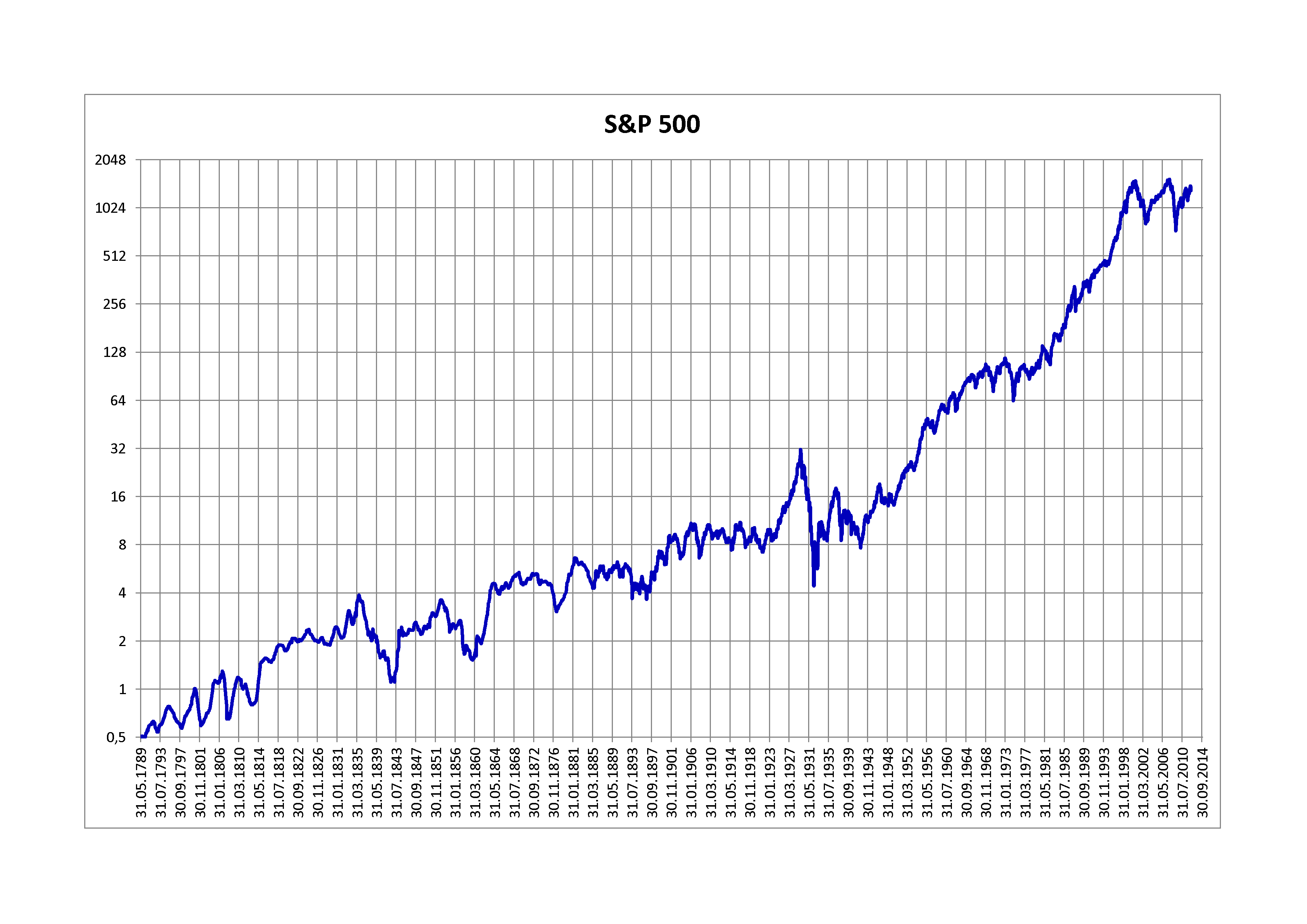

Index funds are a particular class of assets that track an underlying financial index. You already heard at least one of them. The most famous one is the S&P 500, which tracks the top 500 American companies by capitalization. This means that if you buy a single ETF that tracks the S&P 500 you are actually investing in 500 companies. Talking about diversification.

If you feel that investing only in the American market is a bit risky long-term you can always buy ETFs that track different indices. Some others to consider are:

- FTSE All-World Index

- S&P Global 100 Index

- S&P Global 1200 Index

Usually, Trust Funds’ performance is benchmarked against the S&P 500. So if you buy an ETF that tracks the S&P 500 you might do better long-term than most Trust Funds.

The 3 fundamental rules

And remember, based on past events we can distill three fundamental rules that have always applied:

- The market always goes up;

- The market might go down;

- Almost nobody can predict when it happens.

This is why it’s important to invest early and often. Time in the market beats timing the market.

Losing purchasing power

“This is great, but why should I invest in the Stock Market? My bank does just fine”. You are right, but by keeping the money in the bank you are actually losing money. You are not losing physical money, you are losing purchasing power thanks to inflation. At the time of writing US inflation rate is 8.52% with a long-term average of 3.26%. By using the stock market you can compensate for inflation thanks to the appreciation of your assets and the profits from them. Even if, considering inflation, you don’t make a profit in the long run, you will retain some purchasing power.

Every day that you are not investing you are losing money. (myself)

That is because the stock market will go up, prices will go up, and prices of goods will go up. Based on historic trends they always did and always will. If you ever looked back at a stock price and said: “If I just invested x years ago”. But you will say the same thing 10 years from now, so with not just start now?

The best time to invest was 20 years ago. The second best time is now.

Recommended books

If you want to read more about the topic I highly recommend A Random Walk Down Wall Street. In the book, the author retraces the history of the stock market, its major bubbles, and the most important theories you need to know before investing. A big portion of the book is devoted to explaining indices and why you should pick ETFs instead of single stocks. In this post, I have just highlighted the bacis concept that I believe everyone should know.

Disclaimer: This is not financial advice and I’m not a financial advisor.

Until next time.